Hands on Quickbooks Training Classes

in Nashville, TN

This upcoming hands on Quickbooks training class in Nashville, TN will be using Desktop Pro, Premier, and Enterprise versions of the software.

Aug 12 - 13, 2024

Franklin Marriott Cool Springs

700 Cool Springs Blvd

Franklin, TN 37067

Students working on Quickbooks in Nashville, TN

To enhance your learning & retention, we provide pc computers & a mouse for each registrant to use during this course; enabling you to practice the lessons along with the instructor throughout our interactive Quickbooks training workshop in Nashville.

Note: your instructor's computer is connected to a projector so that you will always be viewing their screen and real world examples as they proceed through the lessons with you.

Small Quickbooks Classrooms in Nashville, TN

We keep our average class size to about 10 people for a better student-to-teacher ratio and a more personal and comfortable learning atmosphere.

Early registration is encouraged to secure your seat in this upcoming Nashville class.

Quickbooks Certified ProAdvisors in Nashville, TN

Our friendly Quickbooks instructors are certified in Quickbooks Pro/Premier, Enterprise, & Quickbooks Online Edition. Our experienced trainers are here to help you and to ensure you succeed. Whether you are a beginner, or have some experience and want to learn more, we absolutely can & want to help you.

Quickbooks Course Lesson Plan and Guidebook

Our nationally proven Quickbooks lesson plan and guidebooks have helped thousands of people across the country; and our flexible teaching style with student interaction ensures your success.

See just below the registration form for the complete curriculum and details.

Aug 12 - 13, 2024

Franklin Marriott Cool Springs

700 Cool Springs Blvd

Franklin, TN 37067

$729

Quickbooks Desktop:

Pro, Premier, & Enterprise

9:00 am - 4:30 pm

Nashville, TN Quickbooks Class Registration

We will get back to you as soon as possible

Please try again later

- Curriculum

See below for a list of topics and lessons that we cover on each day.

Note: while we do cover the lessons provided each day in the course manual, we are not limited to these topics and regularly expand upon them during each workshop to ensure that all of your questions are answered and your problems are solved.

- Day 1 - Lesson Plan

Getting Started:

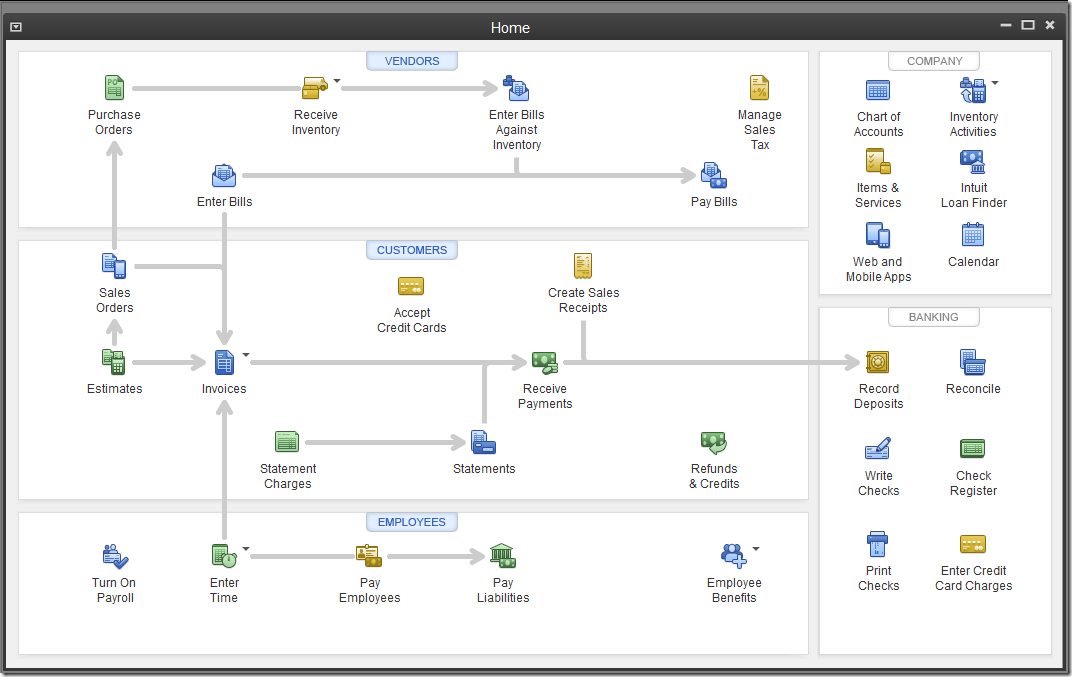

Learn how to easily navigate Quickbooks and how each person can customize and create shortcuts for their own preferences and style. Learn tips, tricks, and shortcuts. Learn how to use forms, simplify your data entry, and gain confidence right away that you're doing things correctly.

How the Company is Set Up:

Learn how to setup your company and/or learn about the choices that were made when your company was initially set up. Learn how to customize Quickbooks® and how to set preferences that are specific to your company and to your needs. Learn how to make corrections, fix setup errors, and/or clean up your company without having to start over.

Working with the Lists in Quickbooks:

Add vendor & customer information into Quickbooks® lists; and learn how to fully utilize the customer, vendor, & employee centers. Learn tips for managing the lists such as: sorting, merging, editing, hiding. Learn how to add to, and edit, the Chart of Accounts. Learn how to clean up older or incorrect list items and also how the use of these lists are the key to making Quickbooks run smoothly and efficiently.

Working with Bank Accounts:

Understand the difference between writing checks vs. entering & paying bills. Record bank account entries such as: debit card transactions, hand written checks, phone payments, online banking, and bank transfers. Learn about the reconciliation process; and learn shortcuts on how to reconcile quickly and efficiently. Learn how to find reconciliation errors and how to correct them.

Understanding the Chart of Accounts and other accounts uses:

Introduction and light discussion on other account types in Quickbooks® such as assets, liabilities, and equity. Learn how to track and record credit card purchases and reconcile them quickly.

Tracking Sales in Quickbooks:

Enter sales, track accounts receivable, learn how to work with the Quickbooks item list, how to memorize transactions, how to add price levels, how to apply discounts to customers, and also how to record sales for those of you who do not invoice customers. Receive money and make deposits correctly. Handle partial payments, overpayments, prepayments, and NSF checks. Apply credit memos and discounts easily. Understand the purpose and usefulness of the undeposited funds account. Learn about common deposit mistakes and how to correct them.

Entering & paying bills:

Learn about different options for handling bills and expenses in Quickbooks; and how to pay bills quickly and efficiently. Learn how to easily take discounts for early payments, and how to apply vendor credit memos. Learn the various ways to track your company's expenses, and which option is the most efficient way for you.

Reports:

A basic introduction to the report menu for those who enroll in Day 1 only. Learn how to navigate the report menu and how to find the reports that can assist in your company's business review. A deeper dive into reporting and financial analysis is covered on Day 2 of the Quickbooks Training Class.

- Day 2 - Lesson Plan

Reports:

An in-depth and detailed discussion on the reports menu and the options available to you. Fully and easily understand the possibilities of financial analysis in Quickbooks and for your company. You will also learn how to easily find transactions and gain a better comprehension of the data that you input every day.

Setting up and Using Inventory:

We will demonstrate the proper inventory setup as well as the correct workflow from the purchase order - to receiving the item(s) - to paying for the product. Easily & accurately make inventory adjustments when & where needed, correct quantity errors, track backorders, and maintain accurate counts and value.

Track and Pay Sales Tax:

Gain an understanding of sales tax tracking and how to correctly report & pay liabilities. Learn how to properly apply sales tax to a customer and to an invoice. Learn how to account for multiple tax agencies when and if needed.

Quickbooks Payroll:

We will demonstrate the different payroll options offered by Intuit. You will learn how to set up your employees and also how to setup your payroll items (those different line items that appear on an employee paycheck). Learn how to add other additions to, and/or deductions from, an employee paycheck. Learn how to pay your employees, remit tax liabilities, and how to file your tax forms.

Estimates, Progress Billing, and Job Costing:

Learn how to create estimates and sales orders (aka bids, proposals, or quotes); as well as sub-customers and jobs. Learn how to save time by copying and/or memorizing past estimates. Learn how to turn your estimate into an invoice; in full, or partially (progress invoicing). Learn about the various project reports as well as job & project status. Learn how to create reports for time and expense tracking; and analyze profitability by job/project, or client/customer. In Quickbooks Premier or Enterprise, learn how to create a purchase order directly from your estimate or sales order.

Tracking Time in Quickbooks:

Learn how to track and analyze time spent on a project, job, or client. Learn how to use the Quickbooks timesheet (and other time tracking apps) to track your hourly employees and integrate it with your payroll. Learn how to invoice a customer for time, reimbursable expenses, or mileage.

Customize the Templates in Quickbooks:

Learn how to modify preset business forms & customize invoices, estimates, and more. Add your company logo. Create custom fields for your business forms and obtain better detail & analysis in your reports. Design custom invoices & business forms specific to your company's needs.

We look forward to working with

you;

and helping

you

succeed as well.

COMMON QUESTIONS

-

What time does class begin and end each day?

Class begins each day at 9:00 am and ends around 4:00 pm. We have a one-hour lunch break, and one or two 10 minute breaks throughout the day.

-

Is there a registration deadline?

There is no registration deadline. Please note however, that we are on a first come, first served basis and cannot accept more than 12 people maximum (usually only 10) per class, so early registration is recommended.

-

Do I need to bring my own computer?

No you do not. Laptop computers and a mouse are provided during the course. However, if you would like to bring your own computer, you may do so and the sample practice company can be loaded onto your device. Please ensure that Quickbooks 2021, 2022, or 2023 is installed on your computer if you do opt to bring your own.

-

Why do we prefer hands on training?

We cover a lot of information in 2 days, so we find that the hands-on practical application assists with the retention of all the material. If you find that the pace of the course is going faster than you can type, feel free to follow along with your instructor on the overhead screen as he/she demonstrates the examples and lessons; and participate in the discussions that we have around those topics. It's up to you - you choose which method works best for you.

-

What is your cancellation policy?

Your reservation for the course is only guaranteed upon receipt of payment in full. Refunds for cancellations can only be honored if the request is made 10 days prior to the class date, less a $75 cancellation fee. Please contact our office if you need to cancel after the 10 day deadline and we will attempt to accommodate you with our live, instructor-led web class or with another workshop in your location upcoming in the future. Please email cancellation requests to our admin department here. You will also have an instructor's contact information upon your registration confirmation and you can email them directly anytime as well.

-

What's included with the course?

- Computers provided for each registrant

- Smaller classes for better student-teacher ratio (max class size is 12)

- Free online refresher course for up to 6 months

- Step by step illustrated guidebook (emailed as pdf the week before the class)

- Classes guaranteed taught by Intuit Certified ProAdvisors

- Certificate of completion (upon request)

-

Is the instructor physically present in the classroom with us?

While there are a few companies that now offer a video conference of their instructors, in lieu of having the instructor physcially present with you in the meeting room, we are absolutely not one of them. Our instructors are physically present with you and meet and work with you in your meeting room location. While we do offer live, monthly online webinar classes, that are a wonderful option and work out great for a lot of people, our on-location classroom training does indeed have a physcial person there with you in the class location, and is absolutely not a video conference of them.

-

My city is not listed, but I wish to attend your class.

You can either sign up for our live, instructor-led, monthly online webinar class , or you can request that we notify you when we will next be in your area. We schedule classes monthly, so we could be coming to your area in the future. You may also check other states and cities around you to see if we might be hosting an upcoming class in a neighboring city/state.

-

Is lunch provided?

No, food is not provided but we do take a one-hour lunch break each day around 12:30; and most class locations have restaurants within the establishment or restaurants near the location.

-

What should I wear?

Casual dress is fine. Meeting rooms are generally kept cool so we recommend bringing a light jacket or sweater.

-

Have a different question? Need to contact us?

-

"I want to tell you that yesterday's class was very informative and you are a great instructor. I have accounting experience, but for those who don't, you make it very easy to understand. Thank you." - Pia, Portland, ME

-

"This class was worth every penny and worth the time it took for me to drive here. You have saved me so much time and demonstrated perfectly how to fully utilize this program. Thank you!!" - Tammy, Oklahoma City

-

"I want you to know, I was not looking forward to this course & really didn't think I could learn much from a class, but I was so blessed! I was really frantic about changing to an accounting program and I came away from this class with so much peace. I really think I can do this! Thanks for not "just reading" the materials to us and for allowing plenty of time for questions. I learned a LOT in just one day. Thanks again!" - Peggy, Phoenix, AZ

-

"I learned more from you in the first day than I have from my current trainer who's been helping me for the past 6 months." - Timothy, Annapolis, MD

OUR QUICKBOOKS CLASSES IN NASHVILLE BENEFIT BOTH NEW AND EXPERIENCED QUICKBOOKS USERS:

-

New Quickbooks Users:

Learn QuickBooks and become a confident user. Discover everything that QuickBooks can do for you. Don't waste time through trial and error learning. Master the fundamentals with our live, hands-on QuickBooks training course. If you want to reduce frustration, increase accuracy, and navigate Quickbooks with ease, then this Hands On QuickBooks training class in Nashville is for you! Our classes are fun and interactive and promise to keep you excited throughout the course. Register now as class sizes and computers are limited.

Button -

Experienced Quickbooks Users:

Solve your toughest problems, increase your efficiency, grow your knowledge and produce better reports by spending 2 days in one of our Nashville QuickBooks training classes with an Advanced Certified QuickBooks expert who can help answer all of your questions. Ensure that you're doing it right! Discover the most accurate & efficient ways to fully utilize this program. Learn new tips and tricks. Let us help you become more productive and effective at your job. Get the expert Quickbooks help in Nashville that you need now!

Button