Quickbooks Training Classes held online monthly

Participate in the next live, Instructor-led Quickbooks Training Class online

Follow the instructor step by step and ask questions and for demonstrations, just as you would in a classroom

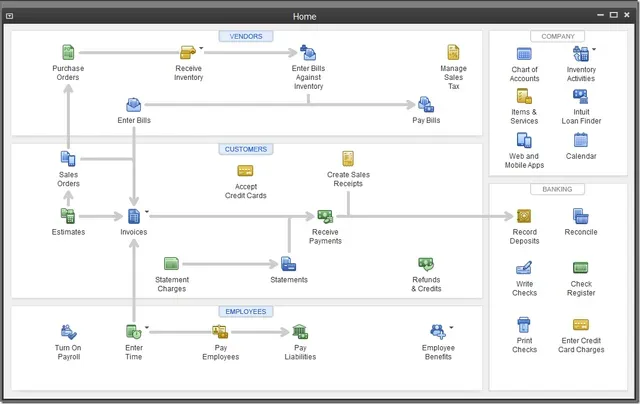

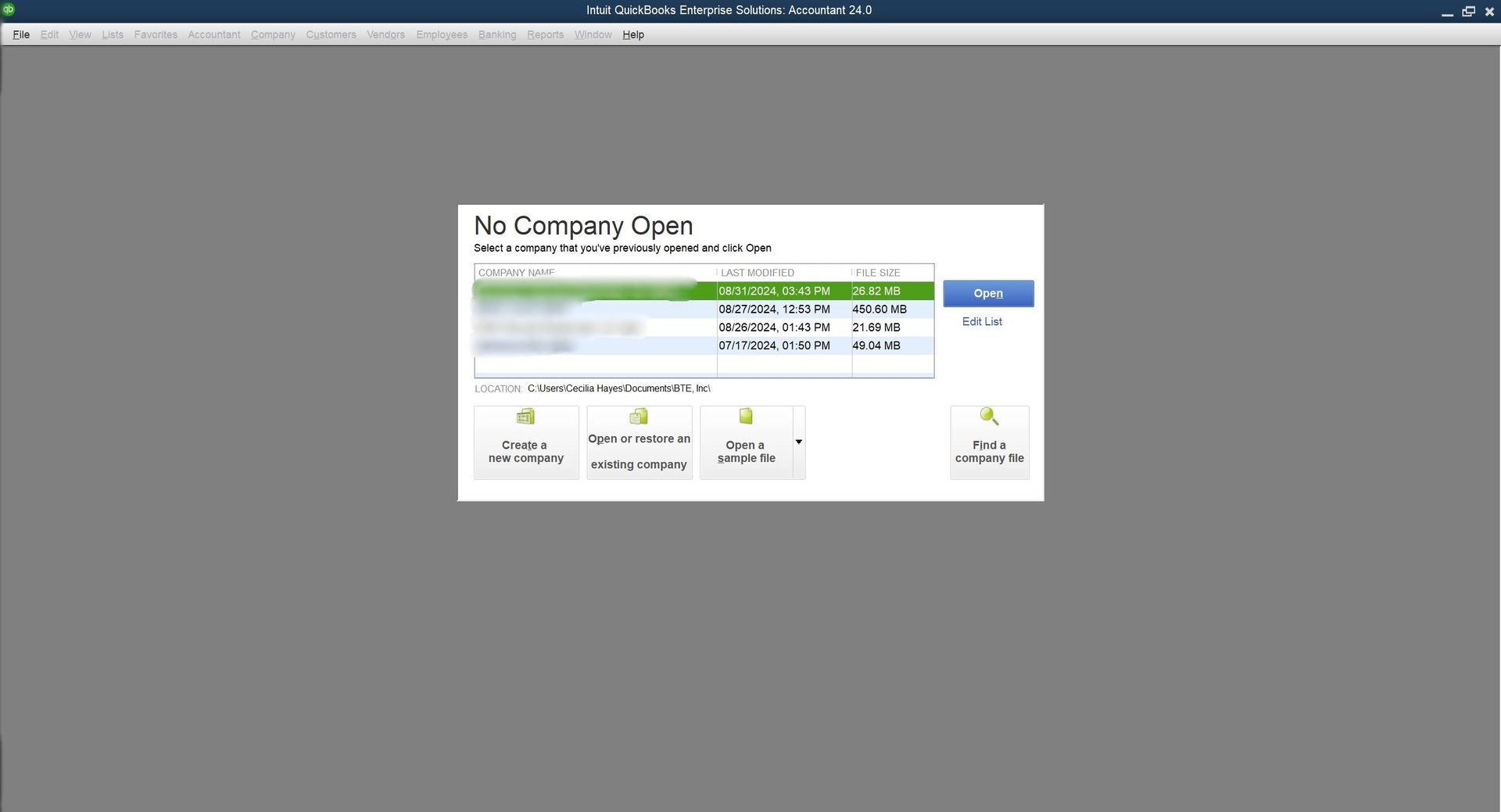

Quickbooks Desktop

Pro, Premier & Enterprise

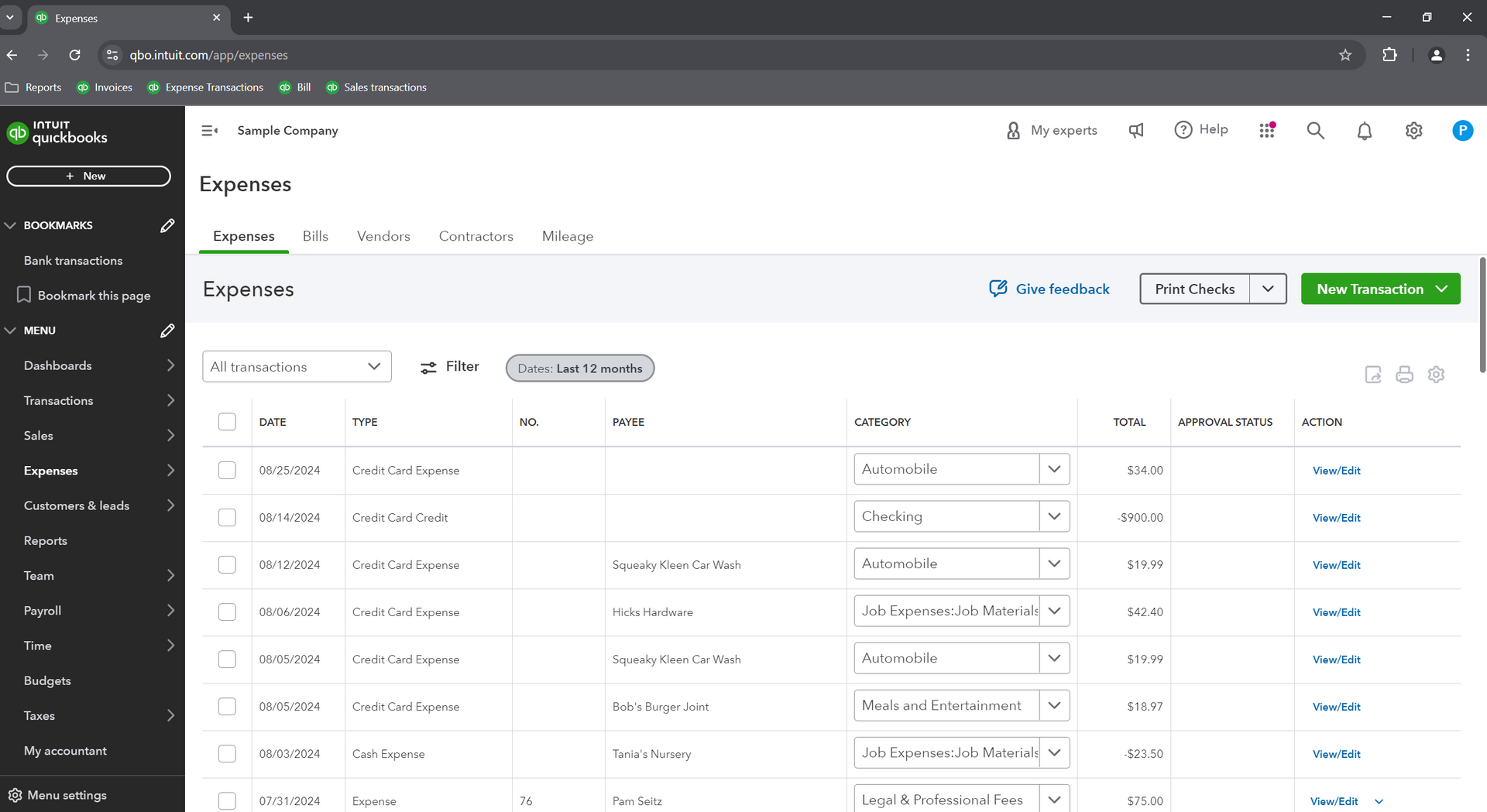

What if I need QBO - Quickbooks Online Edition?

QBO Classes

QBO ClassesIf you need QBO - Quickbooks Online Edition of the software, click here for the upcoming classes.

OUR CLASS SIZES ARE LIMITED AND KEPT SMALL TO ENHANCE YOUR LEARNING SO EARLY REGISTRATION IS ENCOURAGED.

Curriculum for Quickbooks Desktop online classes

Note: while we do cover the lessons provided each day in the course manual, we are not limited to these topics and regularly expand upon them during each workshop to ensure that all of your questions are answered and your problems are solved.

“Thanks for a Great Class! I was apprehensive about taking a QuickBooks class online because of the interaction and keeping my attention for 3 days in front of a computer. I had worked in a pharma training department, as well as in a territory as a regional sales trainer, where we used online Go To Meeting training for all of our training and certification needs. I have attended over 100 online training sessions in my career and this is one of the best classes that I have ever attended! Cecilia Hayes' style allows student interaction along with real world examples based on your needs. She is a 'Guru'! I look forward to taking advanced classes with her in the future."

Our Quickbooks Classes Online are easy to join

Simply connect to our computer on the day of the training class via GoToMeeting (connection links, instructions, and course materials emailed to you the week before the class), grab a notebook, and follow along with your instructor; just as you would in a classroom. Feel free to participate as much as you like, ask questions and for demonstrations, or for any other examples and details along the way.

What do I need to join the course?

The only thing you need is a computer with high speed internet access. You do NOT need Quickbooks software on your computer during the training class.

How do we communicate during the class?

For the audio and to communicate during the course, you can use: (1) your computer's built-in microphone, or (2) a headset that can plug into your computer, or (3) you can use any telephone and call in (phone number provided in emailed instructions), or (4) you can opt to type your questions into a provided chat box. You choose which communication method works best for you.

Can we help further?

“Cecilia, you are a VERY good instructor. I was nervous about taking a 'webinar', but you have definitely made me feel more comfortable. Thank you for a great class and presentation.”

Claire

Missouri

“I want to tell you that you did a great job! You were very patient, helpful and knowledgeable. You responded to all questions and even said 'you're welcome' when thanked for your help. I very much enjoyed your class.”

Kim B.

New York

“I want to tell you that yesterday's class was very informative and you are a great instructor. I have accounting experience, but for those who don't, you make it very easy to understand. Thank you.”

Pia

Maine

Mastering Quickbooks in one of our online classes is a quick and easy way to learn the program without having to take 2 full days away from your work.

Learn and master Quickbooks easily with our live, certified instructor-led program from the convenience of your own home or office.

Our online Quickbooks class lesson plan is the same as the Quickbooks 2-day in-person course; however, we break the lessons into 3 half days in lieu of 2 full days; to accommodate busy schedules and also so that we don't stay online for longer than 4 hours each day.

Our patient and friendly trainers take great care in ensuring your comprehension of the entire outline and curriculum. Let us help get you up and running, resolve your issues, and answer all of your questions.

Please contact us if you would like to speak directly with one of our instructors or to learn more about Mastering Quickbooks Live and Online.

We very much look forward to your success with this course.

Get your questions answered

Simplify your job

Increase your efficiency

Improve your confidence

Enroll now for the next monthly online Quickbooks class that fits your schedule