QBO Topics for Discussion and Practice:

Topic 1:

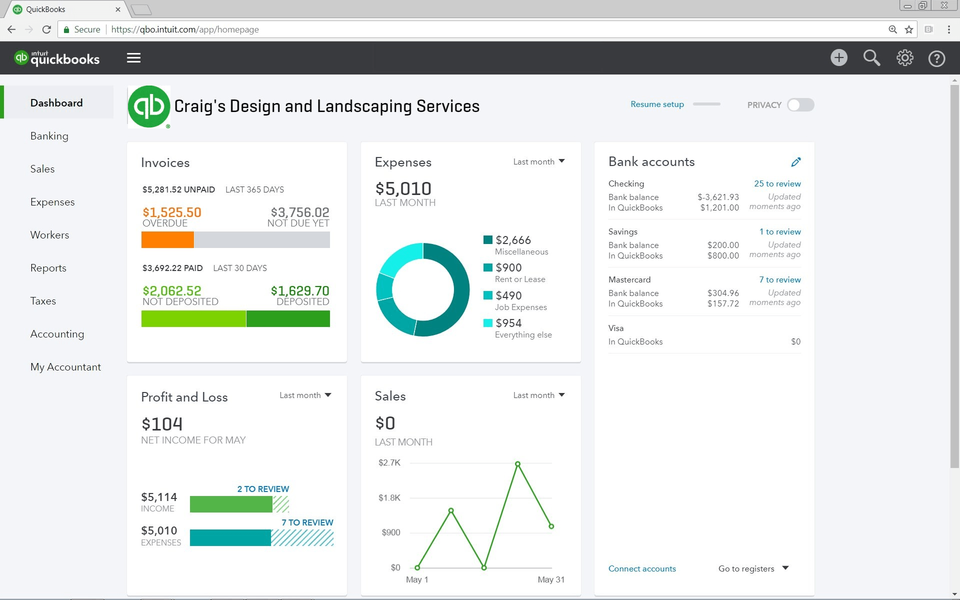

- Product overview

- Importing data into Quickbooks

- Setting up your company

- Manage company settings

- Modify lists and users

- Understand your financial statements

- Set up, clean up, & modify the Chart of Accounts

- Tailor company settings/preferences

- Create custom invoices and other form.

Topic 2:

- Navigating Quickbooks® Online Edition

- Best practices when using QBO

- Navigating Client Home, Customer and Vendor Center, Transactions Tab, Quick Create

- Getting Help quickly

- Shortcuts, keyboard shortcuts, finding transactions fast

Topic 3:

Recording Transactions:

SALES AND REVENUE

- Determine appropriate sales related settings

- Alternate entry points for entering sales transactions

- Estimates and Proposals

- Invoicing for billable time and/or expenses

- Receiving payments and making deposits

- Delayed charges

- Income lists and sales reports

Payroll to be added to the 2nd day for those who need

Topic 3 (cont):

Recording Transactions:

Expense and Purchase Transactions:

- Determine appropriate expense related settings

- Alternate entry points for purchasing and expense transactions

- Writing checks v. entering and paying bills

- Vendor Credits

- Debit card and credit card charges

- Expense List and other Expense Reports

- Set up Inventory, Use Purchase Orders, and adjust inventory

- Set up, track, and pay sales tax

- Other tools

Topic 4:

Working with Bank Accounts

- Bank Reconciliations

- Online Banking

- Handling Customer down payments / deposits

Topic 5:

Reporting

- Intro to Reports

- Reporting Capabilities

- Common Report Settings

- Browser Settings

- Reports Dashboard

- Grouped Reports and Business Overview

- Accounts Payable and Accounts Receivable

- List Reports

- Customize Reports

- Sending Reports and auto email with schedule